Free for Simple Tax Returns. Maximum Refund Guaranteed. Get a Jumpstart On Your Taxes! Industry-Specific Deductions. Get Every Dollar You Deserve. File Taxes From Your Home.

Then enter your income, deductions and credits. This interactive, free tax calculator provides accurate insight into how much you may get back this year or what you may owe before you file. How do you calculate federal income tax? What are allowed deductions?

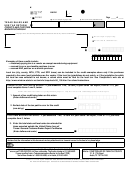

This tax calculator is solely an estimation tool and should only be used to estimate your tax liability or refund. It should not be used for any other purpose, such as preparing a federal income tax return , or to estimate anything other than your own personal tax liability. The IRS estimates that half of the refunds are more than $847. When a taxpayer who is getting a refund does not file a return , the law gives them three years to claim that tax refund.

People with more complex tax situations should use the instructions in Publication 50 Tax Withholding and Estimated Tax.

This includes taxpayers who owe alternative minimum tax or certain other taxes, and people with long-term capital gains or qualified dividends.