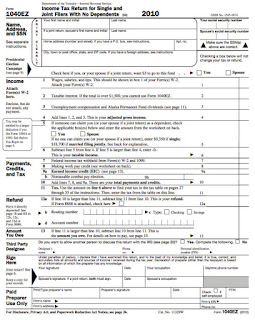

Free for Simple Tax Returns. Maximum Refund Guaranteed. Individual Income Tax Return. IRS Use Only—Do not write or staple in this space. See separate instructions.

Your first name and initial. The not filing tax penalties are higher than the penalties for not paying the tax you owe. The top marginal income tax rate of 39. The general formula for determining taxable income can be presented as follows: Income - Exclusions = Gross Income - Deductions for Adjusted Gross Income = Adjusted Gross Income - Greater of total itemized deductions or the standard deduction.

If you itemize deductions on Schedule A, your total deduction for state and local income, sales and property taxes is limited to a combine total deduction of $10($0if married filing separately). Prevent new tax liens from being imposed on you. Industry-Specific Deductions.

Get Every Dollar You Deserve.

Connect With A Live Tax CPA. Available Nights And Weekends. The Single or Head of Household and Married withholding tables change and the exemption allowance increased from $0to $050.

Include your income, deductions, and credits to calculate.