Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. Convert PDF to Editable Online. No Installation Needed. Individual Income Tax Return.

IRS Use Only—Do not write or staple in this space. For more information on tax benefits for education, see Pub. Select your state(s) and complete the forms online, then downloa print and mail them to the state(s). The mailing address is on the main state home page. How do you get a copy of your tax return?

Download blank or fill out online in PDF format. Secure and trusted digital platform! This is a popular but outdated post so we wanted you to know. See separate instructions. However, you may not have to include all of the canceled debt in your income.

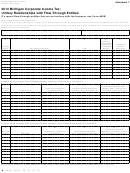

There are exceptions and exclusions, such as bankruptcy and insolvency. Some of the Forms might also list IRS mailing addresses. County where spouse lived County where spouse worked County where you lived County where you worked 1. Do Your Taxes Anytime, Anywhere. Free for Simple Tax Returns.

Maximum Refund Guaranteed. It is the simplest form for individual federal income tax returns filed with the IRS. They are due each year on April of the year after the tax year in question. Note: These advance draft items are not final and are subject to change at any time.