In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. See the instructions for line of the worksheet to figure. The Tax Cuts and Jobs Act modified the deduction for state.

Attachment Sequence No. Your social security number. Medical and Dental Expenses. What taxes are not deductible on schedule a,?

For details on these and other changes, see What s New in these instructions. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly.

Be sure your total gambling and casualty or theft losses are clearly identified on the dotted lines next to line 28. Enter a term in the Find Box. Schedule A is used by filers to report itemized deductions. Select a category (column heading) in the drop down. Click on column heading to sort the list.

You may be able to enter information on forms before saving or printing. Although, going to the main website and downloading the form is the faster method. Use the clues to fill out the relevant fields. Include your individual information and contact details. Subtract line from line 1. You can attach your own schedule (s) to report income or loss from any of these sources.

Itemized deductions allow you to convert otherwise taxable income into nontaxable income if you spend money on certain tax-privileged items. Last year, many of the federal income tax forms were published late in December. Ohio Nonresident Statement. The form does not need to be signe but you must identify yourself by name and Social Security number at the top. Get fillable and editable templates in PDF format.

It is a two page document that gets information about the taxpayer, income and possible adjustments, dependents, allowable deductions, and more. It is by far the most flexible of all the annual income tax forms because it allows you to itemize your deductions. Interest paid—lines 1 1 and 13.

Gifts to charity—line 19. Job expenses and certain miscellaneous deductions—line 27. Other miscellaneous deductions—line 2 excluding gambling and casualty or theft losses. Fill out all required lines in your file making use of our powerful PDF editor. As we mentioned earlier, the line numbers and information collected are the same.

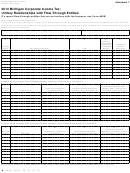

If you itemize deductions, include this schedule with your return.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.