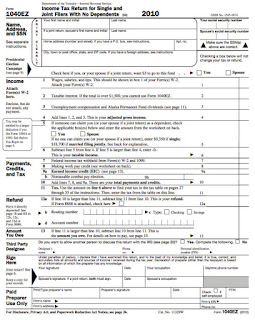

Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. Convert PDF to Editable Online. No Installation Needed. Free IRS E-File at E-File.

IRS Use Only—Do not write or staple in this space. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Tax Table and Tax Rate Schedules.

Illinois Department of Revenue. Income Tax Credit Summary. Select your state(s) and click on any of the state form links and complete, sign the form online and select one of the form save options. Request Copies of Previously Filed Tax Return.

Report Identity Theft. Subscribe to NJ Tax E-News. Links to tax federal and state tax forms by tax year can be found below. The Ohio Department of Taxation has extended filing and payment deadlines for Ohio’s income tax. The filing and payment extension is available to those filing the Ohio individual income tax, school district income tax, pass through entity and fiduciary income tax, and muni net profit taxpayers that have opted in to the state’s centralized filing system.

NOTE: For proper form functionality, utilize Internet Explorer browser and Adobe Reader. Whether it’s about credits and deductions, states with no income tax, or supported forms, you’ve got questions – and we’ve got.