Other articles from investopedia. Individual Income Tax Return. Internal Revenue Service (IRS) form used by individuals to file their annual income tax returns.

IRS Use Only—Do not write or staple in this space. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit. See How Easy It Really Is Today.

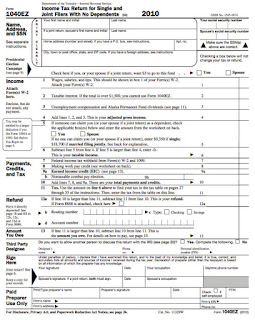

Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. Form definition : The basic form that is used by taxpayers to file their income tax returns.

Schedules may be attached to the form. The form is on one double-sided piece of paper. I would like to receive Nasdaq communications related to Products, Industry News and Events.

You can always change your preferences or unsubscribe and your contact information is covered by. It is used for reporting specific types of income and it allows for capital gains distributions, but for a minimal number of adjustments.

EZ ForIncome Tax Return for Single and Joint Filers With No Dependents. It offers a faster and easier way for individual taxpayers to file their taxes. To be eligible to use this form , a taxpayer must have a taxable income of less than $1000 interest. Anyone who fits the criteria set forth by the IRS is eligible to use it.

Departing Alien Income Tax Return. The tax form for seniors also disallows itemized deductions. And seniors age or older are also entitled to an. Free for Simple Tax Returns. Maximum Refund Guaranteed.

Securely Import and Autofill Data. Do Your Taxes Anytime, Anywhere. In order to be eligible to file this simplified tax form , an individual filer must meet specific criteria. Among these criteria are not owning a business, not itemizing deductions and having a taxable income of less than $10000.

Follow the steps below to find out if a person qualifies as your dependent, qualifies you to take the child tax credit, or both. If you have more than four dependents, check the box to the left of line 6c and include a statement showing the information required in columns (1) through (4). So much time spent on paperwork…File in minutes using a simple online form. This tax document is also.

On the form is your income,.

US, taxation) The main form for US individual income tax filing. You get an exemption for each person you can. Form W-is a crucial document at tax time. It’s the Wage and Tax Statement that reports your taxable income for the year.

Taxes are withheld by your employer and paid in to federal and state taxing authorities if a company reports with a W-2. W-Obligations for Employers.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.