Access IRS Tax Forms. Can I get a copy of my tax return from the IRS? Complete, Edit or Print Tax Forms Instantly. How to read an IRS account transcript?

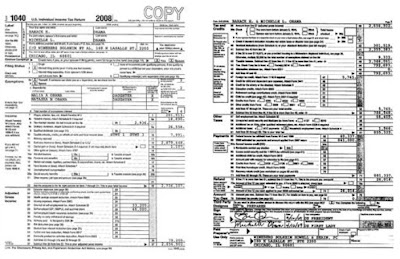

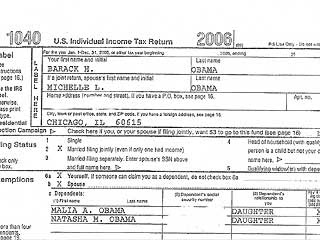

Department of the Treasury—Internal Revenue Service U. Individual Income Tax Return For the year Jan.

This guide includes information about the TaxPack, TaxPack supplement and TaxPack for retirees. Each package includes the guide, the return , related schedules, and the provincial or territorial schedules, information, and forms (except Quebec). General Income Tax and Benefit Package. Personal Income Tax Forms. Prevent new tax liens from being imposed on you.

There is one other thing that may be of help to you and that is a Tax Transcript. A tax transcript is not an actual copy of your return , but it will contain the line by line information that was contained on your return. Efile your tax return directly to the IRS.

Prepare federal and state income taxes online. Brush up on the basics with HR Block. Our free tax calculator is a great way to learn about your tax situation and plan ahead.

For prior years, use the amended return form. You can reduce or eliminate the IRS’s proposed assessments by filing your back tax returns. Login to your TurboTax account to start, continue, or amend a tax return , get a copy of a past tax return , or check the e-file and tax refund status.

The government hopes the measure, which will send most Americans tax. Tax professional bulk orders (PDF) — Tax professionals who seek bulk copies of Ohio tax forms should use this form to order them. File Prior Year Taxes. Even though the deadline has passe you can still prepare taxes for prior years.

Many people who file late tax returns have refunds waiting for them. Use it to file your tax return for: income and capital gains. The page numbers on instructions may not be consecutive. If you desire a system to automatically calculate your tax we recommend electronic filing.

For years not liste please click the following link - Email here to order any Kansas tax. You are not in big trouble, and it is okay that you stated you prepared the return yourself, even though some one else did. Number and Street, P.

The filing and payment extension is available to those filing the Ohio individual income tax , school district income tax , pass through entity and fiduciary income tax , and muni net profit taxpayers that have opted in to the state’s centralized filing system. These services are provided only by credentialed CPAs, Enrolled Agents (EAs), or. She’s gone a step further and released her tax returns covering her time in public service to-date.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.