How do you get a copy of income tax? Can I get a copy of my tax return from the IRS? This article was prepared under the di-rection of Jeff Hartzok, Chief.

Taxes pai the second largest itemized de-duction, decreased 7. Late filing and late payment penalties might apply if you owe taxes.

Department of the Treasury—Internal Revenue Service OMB No. A new client is defined as an individual who did not use HR Block or Block Advisors office services to prepare his or her prior-year tax return. Refer to the current mailing addresses in the Frequently. Easy, Fast and Secure!

Missing Tax Documents? Each package includes the guide, the return , related schedules, and the provincial or territorial schedules, information, and forms (except Quebec). General Income Tax and Benefit Package.

For further help with preparing or efiling your tax return , please contact an efile.

Please use only black ink. Taxpayer Social Security no. If deceased Spouse’s Social Security no. Last name Spouse’s first name (only if joint return ) M. Use UPPERCASE letters.

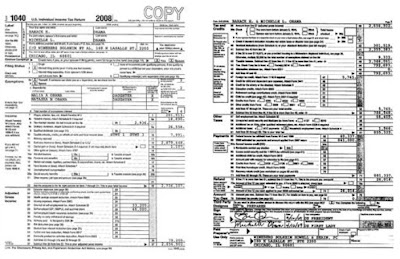

Brush up on the basics with HR Block. Our free tax calculator is a great way to learn about your tax situation and plan ahead. Number and Street, P. Out-of-state purchaSes. See below for a discussion of the changes made. He and the First Lady filed their income tax return jointly and reported an adjusted gross income of $ 50409.

K), LDR is required to collect an percent tax on out-of-state purchases subject to use tax. We use cookies to give you the best possible experience on our website. If you live in a state with a state income tax , you will need to catch up on state returns as well.

NET PROFITS TAX RETURN These are worksheets only. Do not file these worksheets with your return.

Instructions for Worksheets A and B Enter on Line the net income or loss from the appropriate Federal Tax return (s) or if applicable, the Profit and Loss Stateme nt. Prevent new tax liens from being imposed on you. Fill in only one oval. S Single J Marrie Filing Jointly M Marrie Filing Separately F Final Return. Indicate reason: D Deceased.

Timesaver: Calc for Tax is designed expressly to assist anyone who must manually calculate Gross to Net and Net to Gross figures for payslips or to check P45s. Every state makes its own rules for who must file. Check your state’s website for more information. Income Tax Return , must fi le a Utah Fiduciary Income Tax Return , form TC-41. When to File and Pay You must fi le your return and pay any income tax due: 1. Alternatively, you can request a full copy of your return for a fee of $per tax year, payable to the United States Treasury.

Extract the downloaded setup file if necessary. The period in which you.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.