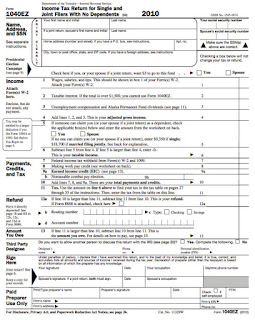

The form contains sections that require taxpayers to disclose. Corporation Income Tax Return. A document that individuals and some corporations must file with the IRS each year.

Also, use Schedule C to report wages and expenses that occured as a statutory employee. Enter your spouse’s name in the entry space at the far right of the filing status check- boxes (next to “Qualifying widow(er)”). See all full list on irs.

Access IRS Tax Form s. Complete, Edit or Print Tax Form s Instantly. The form is divided into sections where you can report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive. This form was for taxpayers with basic tax situations and offered a fast and easy way to file income taxes. Schedule has the following Additional Income and Adjustments to Income. The AARP, the National Taxpayers Union, and the Association of Mature Americans all supported the bill.

This information also goes on line 4. The form must be filed within three years after the original return was filed or within two years after the tax was pai whichever is later. This usually means added tax paperwork needs.

Additionally, many small business owners can use the form to carry back net operating losses that occur in one of the subsequent two tax years. Securely Import and Autofill Data. Do Your Taxes Anytime, Anywhere. Free for Simple Tax Returns. Maximum Refund Guaranteed.

In order to be eligible to file this simplified tax form , an individual filer must meet specific criteria. Pick the right one and it could make a big difference in your tax bill. Learn more about taxes at Bankrate. For example, if you are a freelance writer, consultant or artist, you hire yourself out to individuals or companies on a contract basis. When you prepare your tax return , the IRS requires you to report all of this income and pay income tax on it.

The standard IRS form for individual tax returns. The information requirement, complexity, and eligibility of taxpayers in each form are different from one another. All of the forms use the same tables to calculate your income tax liability.

What are the requirements for filing the easiest tax form ? Departing Alien Income Tax Return. This form is used for aliens who intend to leave the United States in order to report income received or expected to be received for the entire year, and if require to pay the expected tax liability. An income tax return is filed or e-Filed annually usually by April of the following year of the tax year. Depending of your personal tax situation, there are many other forms and schedules they might be part of your complete tax return.

If you discovered that you shortchanged yourself or the IRS, you can make amends.

Share or download the file on any device. The feedback you provide will help us show you more relevant content in the future. It doesn’t matter who you are, how much you earn, or how you earn it. You dismissed this ad.

Our flat-rate $price is for everyone. Everything’s included—seriously. Bid the days of frustrating pricing tiers and “upgrades” goodbye.

Our price is the same for every tax situation, including self-employment.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.