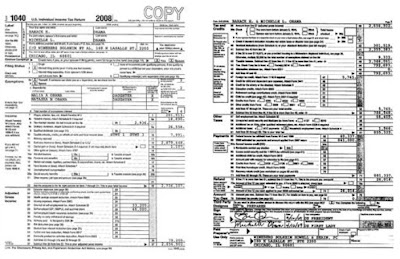

Free for Simple Tax Returns. Maximum Refund Guaranteed. Industry-Specific Deductions. Get Every Dollar You Deserve. Connect With A Live Tax CPA. Available Nights And Weekends. Individual Income Tax Return.

IRS Use Only—Do not write or staple in this space. See separate instructions. Your first name and initial. If a joint return , spouse’s first name and initial.

IRS is offering coronavirus tax relief (check back for frequent updates). Please look for help first here on IRS. Earned Income Credit (EIC) Table Caution. This is not a tax table. To find your credit, read down the At least - But less than columns and find the line that includes the amount you were told to look up from your EIC Worksheet.

Then, go to the column that includes your filing status and the number of qualifying children you have. How to obtain a copy of your tax return? How do you calculate federal tax return?

Federal income tax withheld and excess social security and tier RRTA. If percentage is less than 0. Enter percentage on Line 8. Line - Multiply Line by percentage on Line 8. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! The field of US income tax return holds an important role.

Tax Table and Tax Rate Schedules. It is the simplest form for individual federal income tax returns filed with the IRS.